Basic Bookkeeping for Small Business: A Must Read for Beginners

When you open your new business, you have to consider bookkeeping to keep your financial statements and information. But, what is basic bookkeeping for small business owners?

To start this beginner’s guide is important to clarify that Bookkeeping basics are a record of transactions, which shows you where your money goes, what revenue you to keep earned, and what tax returns you can claim.

Why do you need to do this? It’s simple – for a small business and your company’s finances, tax deductions are a must.

The Importance Of Bookkeeping For Small Business: a beginner overview

A failure to keep your books, categorize all your expenditures, and balance your numbers will eventually cost you money. Also, one-off deductions, like petrol for a long drive to a meeting, tend to get away from busy entrepreneurs and become impossible to find the moment they’re needed.

That’s money down the drain for your business. Well organized receipts and a thorough knowledge of tax deductions saves your company thousands, but only if you keep up your ledgers.

Good bookkeeping for your small business helps you get a business loan. HMRC needs good, well-kept records that show your expenses and revenue statement.

Even if you don’t plan to apply for a loan, your records can help you catch bank errors, double or missing invoices, help you stop subscription fees, and give you a better understanding of your cash flow.

A company with a solid bookkeeping practice and a balance sheet know when to expect a dip in business, how to prepare for an audit, has copies of all receipts for business expenses and always knows how to claim a tax deduction in April. All of this can sound intimidating, but the truth is that bookkeeping doesn’t require much.

All you need as a business owner in the United Kingdom is to schedule the time and download a template. Bookkeeping starts with a simple record of what you earn and what you spend.

Are you a Sole-trader? Check The Simple Guide to Sole Trader Bookkeeping.

Basic Bookkeeping tips for a business owner

Before you begin, you need to separate your small business bookkeeping from your personal accounts. As a businessperson, you need to make it clear to HMRC what you spend for work versus your home so you can avoid legal problems in future.

Do this by setting up a business account with your bank and getting a separate debit card, chequebook, and company name on the account. It should appear obvious to anyone glancing at your bank statements that these are two separate things and one is for your business finances.

Then you need to start with a basic, single-entry bookkeeping account to keep your financial information. A one-column ledger lets you do a quick, easy record of what you spend and what you make.

You may feel tempted to jump right into double-entry bookkeeping, but if you’re on day one and don’t have a lot of financial transactions in your business, this isn’t necessary. You can easily transfer a single ledger into a double-entry later on when your company earns more, you have employees or increase your inventory.

Both help you balance your books and create financial statements. You’ll need those as your business grows and you do more with HMRC, pay more taxes, and spend more from your business account.

Single entry accounting records your bookkeeping transactions once as they happen. You can use the cash method or the accrual method as your means of tracking your capital.

The cash accounting method recognizes revenue when it’s received on your end. For example, when a client transfers funds into your account, you record it in your income statement.

The accrual method recognizes revenue when you earn it, or when you write an invoice. This is a more nuanced approach and works well with companies managing large amounts of inventory.

Bookkeeping basics Tasks for beginners

Finally, you need to create a schedule that lets you be consistent with the bookkeeping process. This practice saves business owners hours of overtime and endless headaches.

To get started, choose a system. There’s no need to invest in complex bookkeeping software if you don’t want to, you can start with an Excel or Google sheet and manually enter your information.

If you choose to buy accounting software, Quickbooks and Xero both have great options for small-scale business bookkeeping. You may need an accountant or tax advice help to walk you through the first week or so of accounting on your own and ensure you don’t get off in the wrong direction.

Once the transaction is recorded, then you need to categorize your activities. This is where an accountant or a bookkeeper can help the most.

It’s essential to understand what’s capital, what’s an asset, how much you spend on advertising, and all the other unique things your venture needs. This all circles back to taxes and will help you see what you can deduct from your business to keep your company profitable while keeping in line with HMRC.

At the end of the financial year, it’s important to walk through your expenses and see what you can deduct. To do that, you’ll have to organize and store your receipts, (digital copies are fine), and manage them beyond shoving them in a shoebox.

You have to keep all of them for a total of three years in case you get audited by the government.

Bookkeeping for beginners: helpful examples

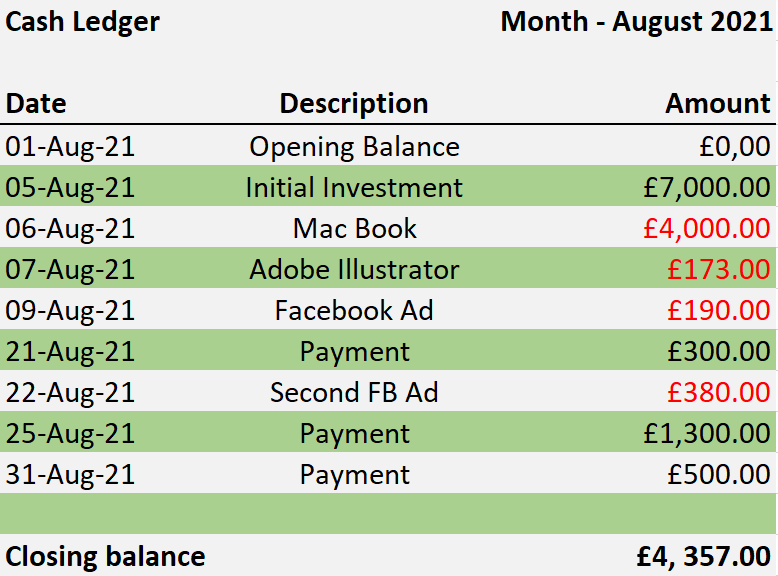

Let’s take a look at a basic single-entry bookkeeping system using the cash method.

Imagine you’ve opened a graphic design agency and want to do your bookkeeping basics for your first month. You have some of your own capital to invest, you want to buy a new laptop and subscribe to Adobe Illustrator and do some advertising.

Of course, you also want your venture to make a profit, so you need to type in your numbers in a way that shows what’s going out and what’s coming in. A single ledger summarizes all of your transactions in one column and uses colours to show cash earn to put into the business, (black), and hard cash spent, (red).

You’ll notice this format looks similar to a bank statement. There’s not a lot of details about how your cash is moving, just totals and a general snapshot of your accounts.

Here you can see what happened in the first month when we talk about assets liabilities equity. You put in £7,000 of your own money as the initial investment, but you also needed a new MacBook and a subscription to Adobe Illustrator to get going.

Then you had to do some advertising, so you spend on a Facebook Ad campaign. Those three expenses get a red number because they show money going out.

Then, on the 21st of August, you get your first customer and that person pays you £300. Now you use black again to show that money is going in. Another Facebook ad gets a red number, but your next two payments show profitable payments and appear in black.

Your new business is a success! You close out August with a profit – £4,357.00 in the bank.

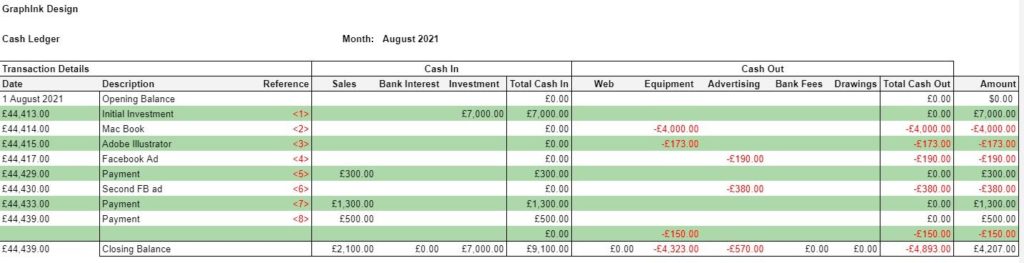

However, this isn’t particularly detailed. Sure, you only just opened, but as a business owner, you may want to keep track of all your financial transactions and this includes spending and earning categories as you go along.

To do that, you can expand on your basic snapshot with a multi-column ledger using the cash method. It’s the same idea and gets you the same amounts, but it also gives you more information to help you with your accounting equation.

This is the same month broken into categories, combined with references, and that helps you out at deduction time. Here’s a closer look at the different sections.

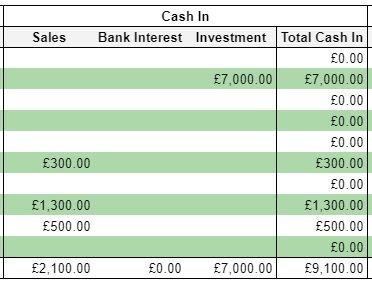

Anything you earn falls into one of the above categories – Sales, Bank Interest, or Investment.

The first investment, the money you put in, goes in the final column. You haven’t accrued any bank interest yet, but you need the column so you can easily add it later, and payments from your first three clients go into Sales.

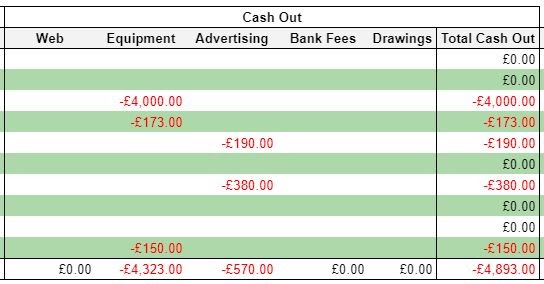

Your expenses help keep your taxes down, but it’s important you know what kind of expense you’re paying and what you can claim. Here you can see there are four different kinds of expenses including anything digital to help you out at tax time.

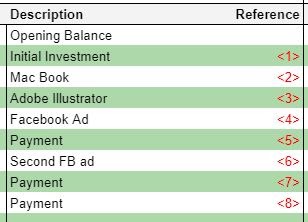

Finally, there’s a column for references to help you dig up old receipts. It looks like this:

Each number references an invoice or receipt for an expense. If you keep digital records of your financial transactions, you can link each one to the corresponding number or label it so you don’t have to struggle to find your records.

Again, a professional bookkeeper consultant can help you get all the accounting process organized and ready to go before you open your doors to customers.

Bookkeeping Basics: Terms a small business owner need to know

Ledger – A common term referencing one category of your accounting, such as a property ledger that tracks rent or sales information for your location.

General ledger – The general ledger is the bookkeeping account that allows you to keep track of all your transactions and accounts. It starts with journals, where every transaction gets recorded in detail. From there, these details make their way into general ledgers before being summarized on a monthly basis for financial statements such as balance sheets or income statements.

Single entry – A method of bookkeeping that only recognizes one side of a transaction in an entry in your ledger.

Double-entry – Every financial transaction has equal and opposite effects in at least two different accounts, namely to satisfy the equation Assets = Liabilities + Equity. Double-entry is a fundamental concept underlying present-day bookkeeping and accounting because it helps create an accurate picture of one’s finances by ensuring that both income (debit) as well as and expenditure (credit), are accounted for with accuracy. For more information, check our comprehensive guide on what is double-entry bookkeeping?

Cash flow – A term that references how money flows in and out of your account, i.e. what you spend and what you earn.

Transactions – Any time money moves in or out of your account. Transactions are represented by bills, invoices, and receipts.

Books – A common phrase meaning your accounting records. Books reference the original practice the original merchants used, keeping large notebooks with records of all their sales and inventory.

Personal account – Anything you spend from your private bank account that is separate from professional accounts.

Business account – The bank account tied to your business or professional cost and money that you earn for your company.

Balance sheet – A balance sheet is a financial statement that reports all of the finances for a company at one point in time. It includes assets, liabilities and shareholders’ equity which can help measure rates of return or evaluate capital structures to determine how they will be used throughout the next year.

Assets liabilities equity – Assets are things that you own, such as your office equipment and company vehicles. Liabilities are debts owed to others; examples include taxes or credit card payments. Equities represent the ownership in a business by its shareholders (aka owners).

Cost of goods sold (COGS) – The cost of goods sold (COGS) refers to the direct costs of producing the goods you sell. This amount includes how much it’s going to take for your materials and labour, leaving out indirect expenses such as distribution or salesforce.

Accounts payable – Accounts payable are the unpaid debts that your company owes to vendors or suppliers. When a vendor provides goods, services, and you have not yet paid them for it, this is known as accounts payable debt. The money owed to these companies will show up on our balance sheet in what’s called “accounts payables.”

Asset account – An asset account is a record of the assets that belong to your company. When you make capital expenditures, these are debited from an asset account and “capitalized.” The amount in this type of account increases when you bring more things into it.

Why Choose Simple Tax Advisory Bookkeeping Services UK?

Our team specializes in keeping you updated on any changes in tax policy from HMRC and ensuring you get exactly the service that works for you.

We love to help small businesses do the best bookkeeping services possible to keep you profitable, no matter what.

FAQs

About the Author

Claudio Alegria is the Chief Operating Officer at Simply Tax Advisory, providing tailored tax returns, payroll, bookkeeping and VAT services to small businesses, individuals and startups.