What is double-entry bookkeeping? Examples & Terms to know

When your accounts represent the flow of money both in and out of your business, you have the essence of double-entry bookkeeping. This method takes all your transactions, expenses, incoming and outgoing payments and represents them numerically in a two-columned ledger.

If all of that sounds confusing, don’t worry. On its most basic level, double-entry bookkeeping is the business owner’s version of doing one’s homework.

A digital or paper ledger with a side for money coming in, (or credit), and another side for money going out, (debit), shows all the workings of your business. When it comes time to report your expenses, do your taxes, or file for tax returns from HMRC, double-entry bookkeeping makes everyone’s lives easier.

The details of how to start using this system and maintain it can feel intimidating, but we created an easy guide for you to follow to help you and your company.

What Is The Difference Between Single And Double-Entry Bookkeeping?

A quick reminder: single-entry bookkeeping is an accounting method to keep track of bills paid and any money you deposit into your business funds. Single-entry bookkeeping works best for newer or smaller companies that don’t have a high volume of incoming business.

You can maintain a paper, single-entry system for the early days or until you can expand, then hand over those records to an accountant come tax time. Once your numbers go up, you hire more people or open new locations, you’ll need a double-entry system.

Double-entry accounting follows the old adage of physics – for every action, there is an equal and opposite reaction. The same happens in money flowing in and out; for every debit, there is a credit.

Your ledger is where each transaction is recorded. It shows where the money came from and what it went towards in a more detailed way.

When an accountant or HMRC rep comes to your business to see how you run it, what you put into your company and what goes out, they want to see your ledger. Even money you’re owed or that you owe to someone else needs to get a space in your books.

Use the double-entry system makes sure no numbers get lost or confused – every transaction and the way it affects your business gets a space in ledger accounts. It is also a great way to have an overview of your financial statements and a balance sheet.

Double-Entry System

So how to get set up and use a bookkeeping system?

All you need is software or a pen and paper ledger that can represent two ends of each transaction (debit credit). While debit is on the right side, credit is recorded on the left.

Then you need to divide your business into all the different accounts that represent how your money moves. Put everything you have into the appropriate labels like liability account, equity accounts, accounts payable, cash account, expense accounts or ledger accounts.

Each of those accounts gets the two-sided treatment, debits and credits. In the end, you have a clear roadmap showing where each round of money came from, and exactly how it trickled out of your business.

Double-Entry Bookkeeping Examples

There are two things to remember when doing double entry. First, the equation Assets = Liabilities + Equity and to debit the receiver and credit the giver.

Here’s what that looks like practice:

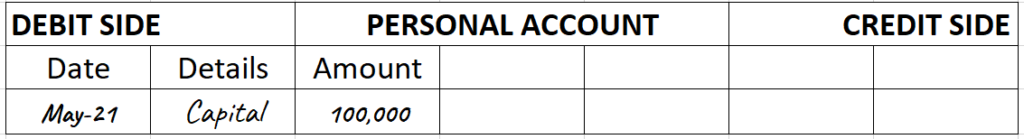

Imagine you open a small coffee shop at the beginning of the year. To start, you put 100,000 pounds in a new, business bank account that you took from your own personal account.

First, you need two places to note this transaction, your personal and your capital account. Use the details column to help you connect the second entry to the first, as shown here:

That entry now gets recorded on the credit entry in a second account – your capital.

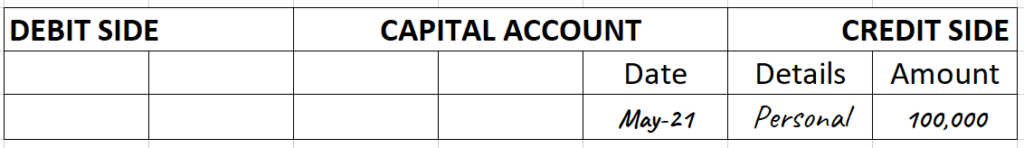

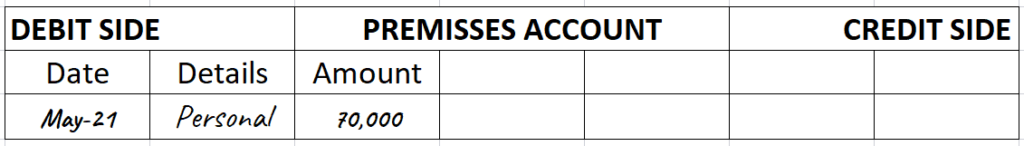

Next, you need to secure the location with a deposit and the first month’s rent to the landlord. That payment goes out from your bank account as a cheque, so here’s how you record it:

Any payments made towards rent, buying property or general maintenance go in a new account, Premises.

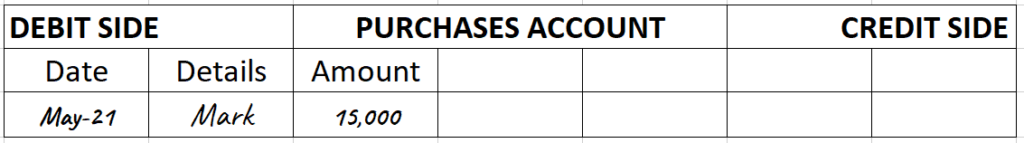

As you get your place set up, you get an invite to a coffee plantation in Ethiopia. It’s expensive, but you know the local area and you’re positive you’ll get more business if you can offer fair trade, locally roasted beans from a small farm.

Your friend Mark offers to loan you the money and you accept. That loan gets a double entry like this:

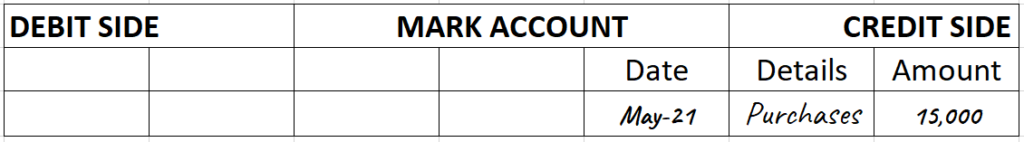

Even if Mark stops after one loan, he needs his own account where you can record the credit. Enter it like this:

Consider getting a consultation with a professional accountant to get all of these accounts properly divided up and labelled (asset account). It can save you hours down the road.

You don’t have to do record every financial transaction with a pencil and paper. Plenty of accounting software can help you keep a track of all this digitally.

Double-Entry Accounting Software

You can maintain your books with a double accounting ledger online or on the computer with the help of several different programs. QuickBooks, Freshbooks, Kashflow, and multiple others help you keep up with the accounting equation.

Several apps can help you bookkeep on your phone. Here are three apps you can use to integrate with your existing accounting system so you never miss a receipt or an invoice.

Kashoo already has raving fans with their simple interface and clear dashboard for their computer program, now they want the app world.

Easy to use on any device, Kashoo lets you balance on the go. You can get it for just over £12.

You can use your phone to manage profit and loss sheets, make custom reports, invoice, and a long list of other tasks.

Reviewers like how it can help with data entry and tracking members of any subscription service your enterprise offers. You can get it for £3.63.

Sage aims to provide solutions for mid to large businesses with their preferred demographic reflected in their higher price. Customers like it because of its highly customizable interface, including email templates and a number of different accounts.

You need to get a quote via their website, but the cheapest it runs is £3.6K.

Double-Entry Bookkeeping Terms You Should Know

As you get into double-entry accounting you’ll start to hear a set of terms during the work. We have a cheat sheet for you here:

General Ledger – This is the bible to keep the health of your business. The place with all your financial information, your sheets, your history, and your master chart of accounts. Keep this well documented and safe to help in case any HMRC reps come knocking at your door.

Chart of accounts – The motherboard of your business transaction. This chart lets you list all the different accounts you need to track and balance. This is a place to list the details of any amount, create categories and subcategories to give you the big picture of all your accounts.

Balance sheets – A quick glance at how your company looks at the moment – deep in the red or safely in the black. These sheets keep track of your assets, liability and equity so your accountant can get a snapshot of your financial statements.

Bank reconciliation – Your double-entry accounting helps you track your finance account and venture account with or without the bank. A bank reconciliation lets you see if your maths match the bank’s and helps you point out any discrepancies you find on their end.

Trial balance – As you get some practice with your bookkeeping, you want to check your work and make sure you’ve got it right. A trial balance lets you check on your total debits and credits each month, quarter, or the year before going to a professional so you can feel confident you know how much taxes you owe come April.

Why Is Double Entry Bookkeeping Important?

Use double-entry bookkeeping is the homework every venture owner must complete as part of running a company. Without it, accounts get overdrawn, employees go unpaid, and taxes become a massive headache.

In other words, use double-entry bookkeeping makes for good administration, keeps your firm open, and helps you stay profitable. It helps you cover all your liabilities, gets each payment owed to you and makes sure you claim all tax returns due to you by the government.

It sounds like a lot of work, but plenty of professionals with years of experience can help you manage your books and stay on top of your numbers.

Why Choose Simple Tax Advisory Bookkeeping Services?

At Simple Tax Advisory, we strive for the highest standard of professionalism and make sure all our clients know about any new government policies that affect their businesses. If we know about a tax allowance, a new grant for your latest project, or the possibility you could profit more, we work hard to make sure you get your money. Check our Bookkeeping Services for Sole Trader, Small Businesses and Limited Companies in the UK!

FAQs

About the Author

Claudio Alegria is the Chief Operating Officer at Simply Tax Advisory, providing tailored tax returns, payroll, bookkeeping and VAT services to small businesses, individuals and startups.