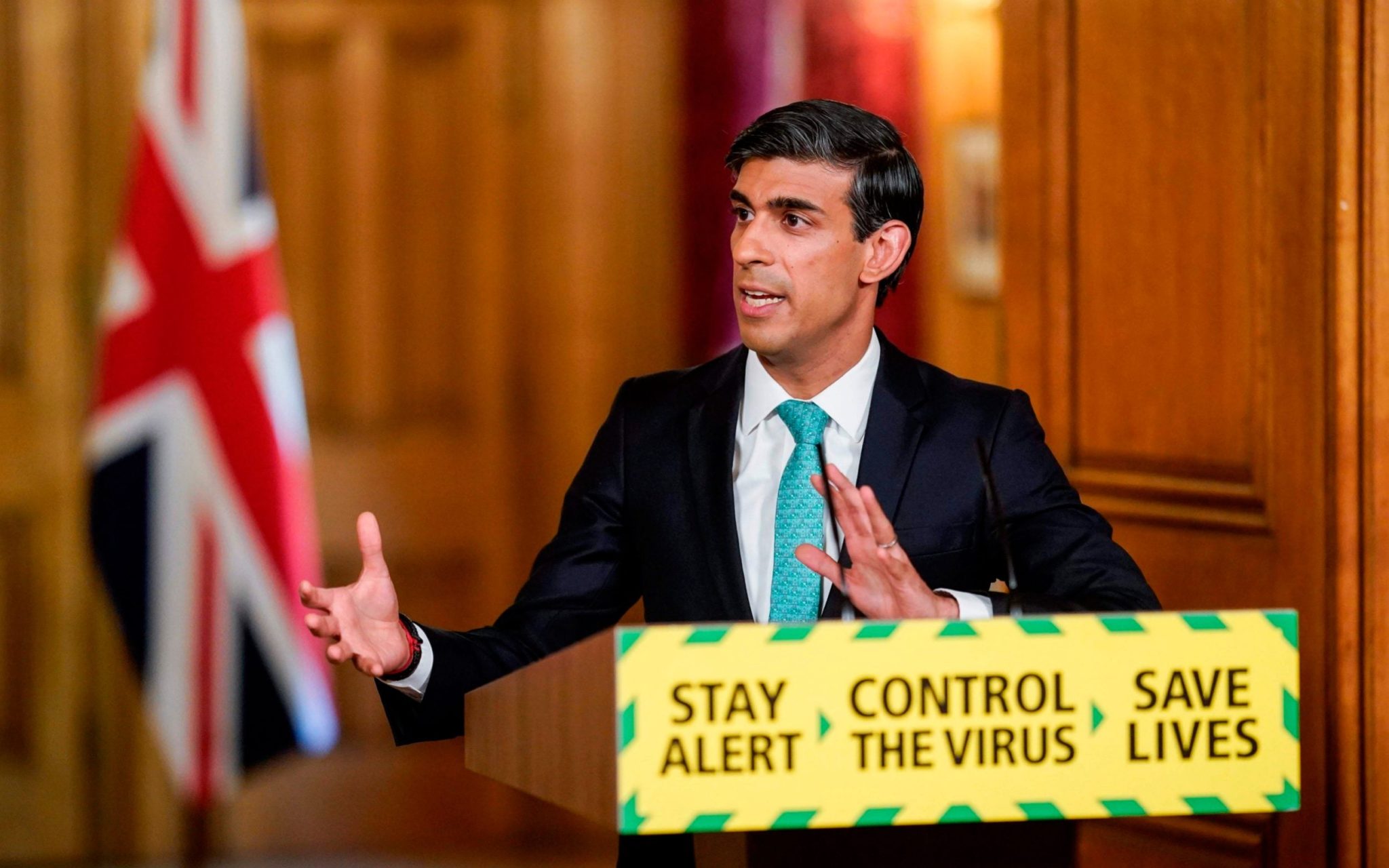

Rishi Sunak announces ways to kick-start the economy

Job Retention Bonus

A one-off payment of £1,000 to UK employers for every furloughed employee who remains continuously employed through to the end of January 2021. Employees must earn above the Lower Earnings Limit (£520 per month) on average between the end of the Coronavirus Job Retention Scheme and the end of January 2021. Payments will be made from February 2021. Further details to be released by the end of July.

Housing

Temporary Stamp Duty Land Tax (SDLT) cut

The government will temporarily increase the Nil Rate Band of Residential SDLT, in England and Northern Ireland, from £125,000 to £500,000. This will apply from 8 July 2020 until 31 March 2021.

Youth

Payments for employers who hire new apprentices

A new payment of £2,000 to employers in England for each new apprentice they hire aged under 25, and a £1,500 payment for each new apprentice they hire aged 25 and over, from 1st August 2020 to 31st January 2021.

Traineeships for young people

The government will fund employers who provide trainees with work experience, 16-24-year olds at a rate of £1,000 per trainee.

Hospitality Sector

Eat Out to Help Out

Participating restaurants, cafés, pubs or other eligible food service establishments will entitle every diner to 50% discount up to £10 per head per meal. The discount will be at unlimited times and will be valid Monday to Wednesday on any eat-in meal (including on non-alcoholic drinks) for the entire month of August 2020 across the UK.

Temporary VAT Cut For Accommodation And Attractions

A reduced (5%) rate of VAT will apply to supplies of accommodation and admission to attractions across the UK from 15 July 2020 to 12 January 2021.

About the Author

Claudio Alegria is the Chief Operating Officer at Simply Tax Advisory, providing tailored tax returns, payroll, bookkeeping and VAT services to small businesses, individuals and startups.